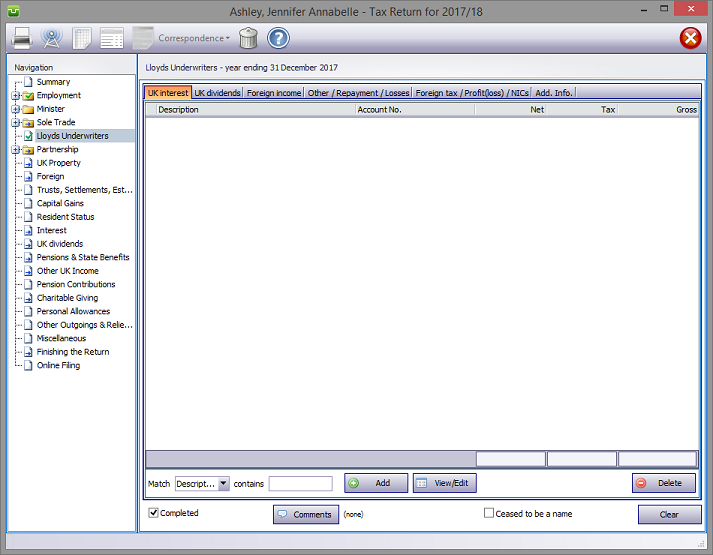

In the Navigation pane click on Lloyds Underwriters

Please read the HMRC document sa103l-notes.

Lloyds Underwriter's details

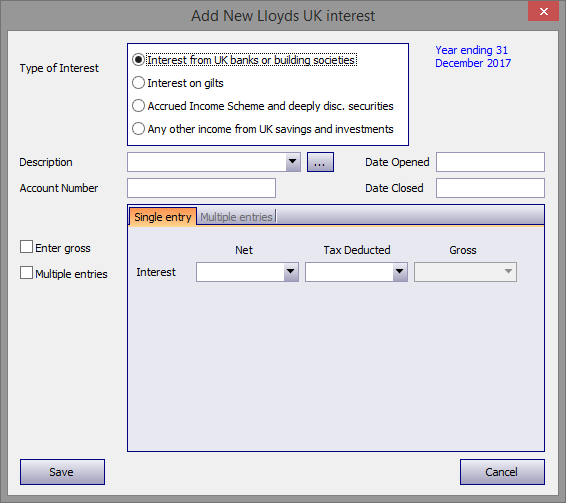

UK interest

Click Add to enter a new source or View/Edit to update an existing one. Select the Type of Interest and enter the appropriate details. See Interest for more detailed information.

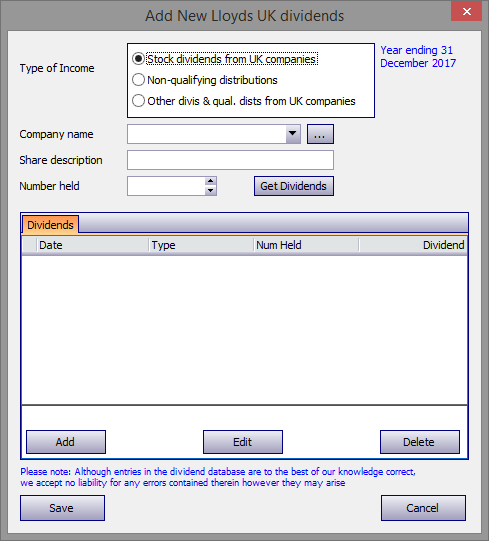

UK Dividends

Click Add to enter a new dividend or View/Edit to update an existing one. Select the Type of Interest and enter the appropriate details. See UK Dividends for more detailed information. The database shows dividends paid in the calendar year by the top LSE quoted companies.

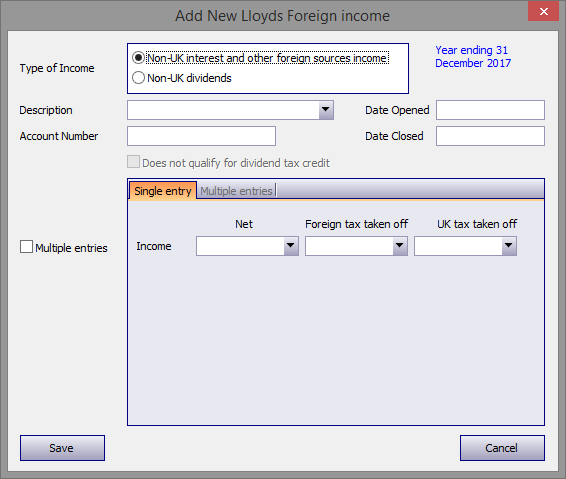

Foreign

Click Add to enter a new source or View/Edit to update an existing one. Select the Type of Income and enter the appropriate details.

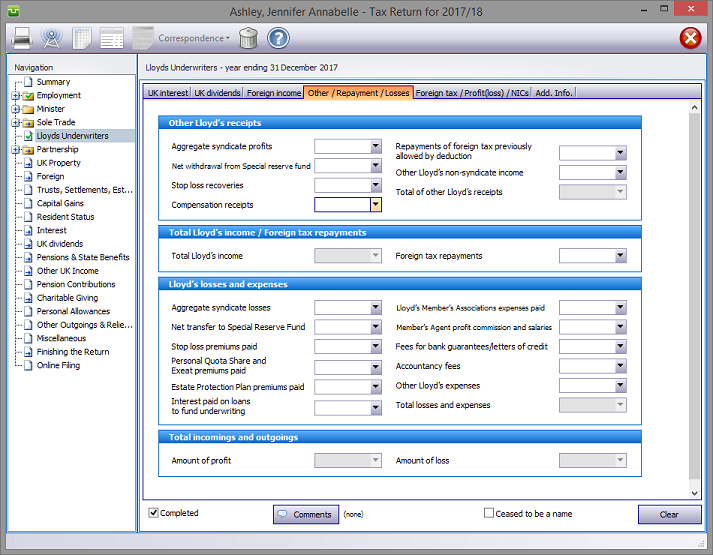

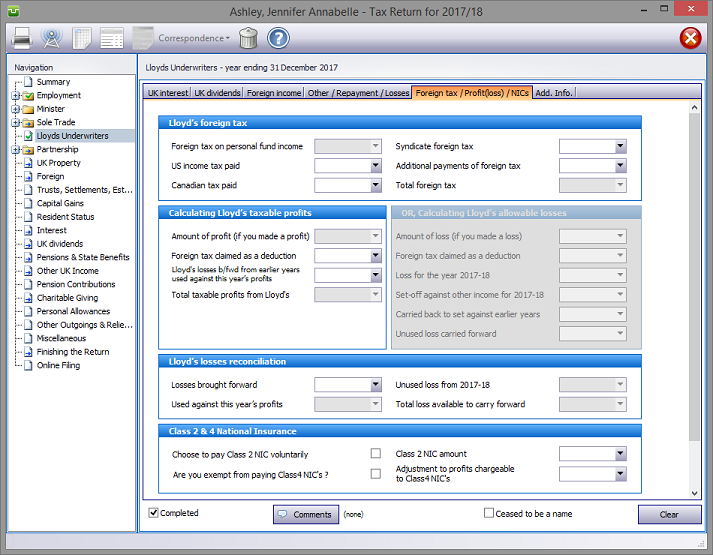

Other/Repayment/Losses, Foreign Tax/Profit(loss)/NICs

Enter your client data as appropriate and the relevant tick boxes.

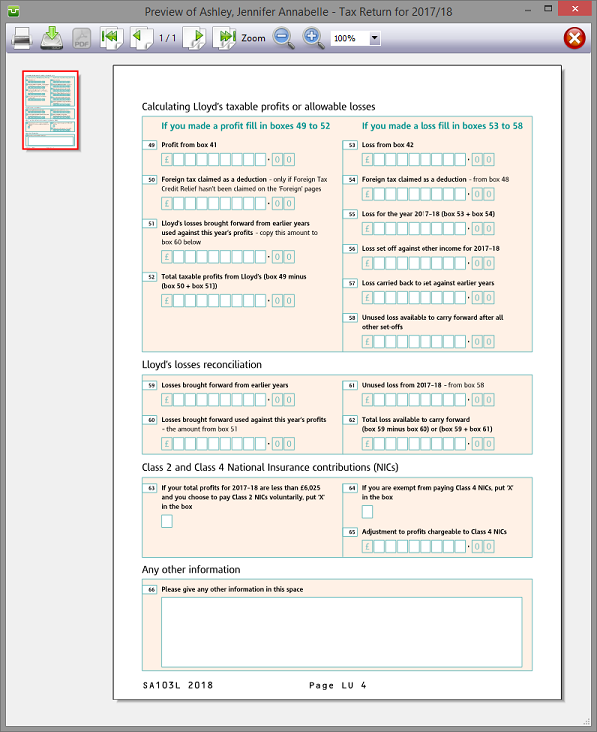

Entries made on the Additional Information tab will be printed in box 66 on page LU4 of form sa103l. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Note that the Copy facility available in other (non Lloyds) sections is not considered relevant for Lloyds entries.

Finishing

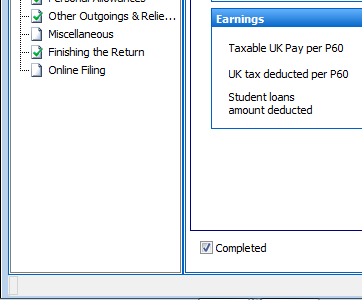

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

When it is no longer necessary to complete Lloyds pages ensure that standing data is not carried forward to later years by checking the Ceased to be a name tick box in the lower right of the screen.

| Notes | Helpsheets | ||

| sa103l-notes | Lloyd’s | hs240 | Lloyd’s underwriters |

Copyright © 2025 Topup Software Limited All rights reserved.